Revisiting the S&P 500 Dividend Aristocrats fundamental model

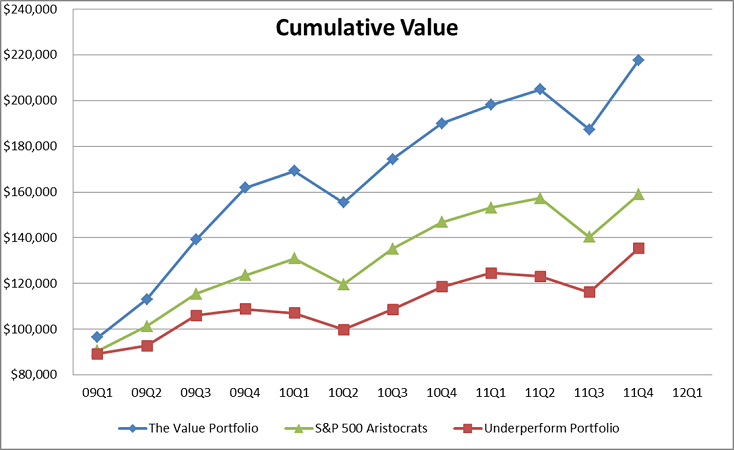

Due to the interest in my latest article on the S&P 500 Dividend Aristocrats (Finding Value in the Dividends Aristocrats List) and the discussion about backtesting, I thought I would share the empirical model I developed… Read More »Revisiting the S&P 500 Dividend Aristocrats fundamental model