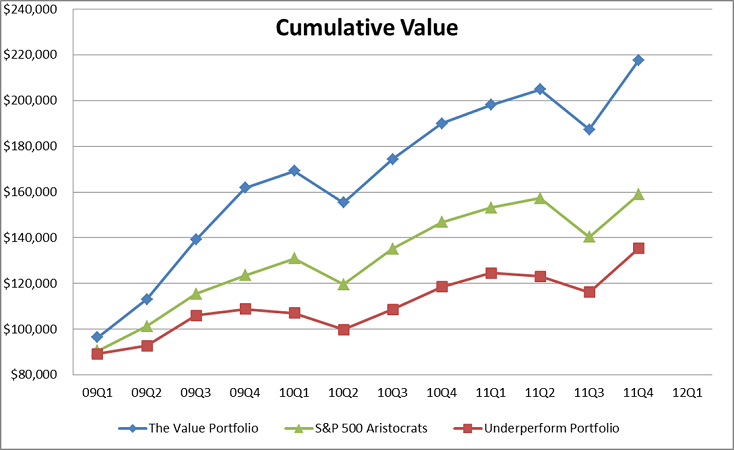

Yet Another Reason to Pay Attention to Value Stock Models

2016 began with a sharp spike in volatility with investors concerned the bull cycle could be over. Now is more than ever a great time to consider value stocks to remove risk in your stock… Read More »Yet Another Reason to Pay Attention to Value Stock Models