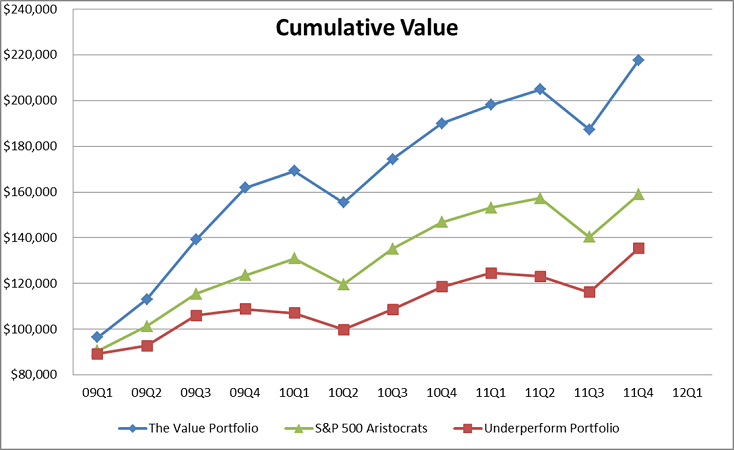

Measuring Performance of Dividend Champions Selections

It’s been six months and it is time to check in on the performance of the Value Portfolio. Heck, with all of the market volatility in the last two weeks, perhaps it makes sense to… Read More »Measuring Performance of Dividend Champions Selections