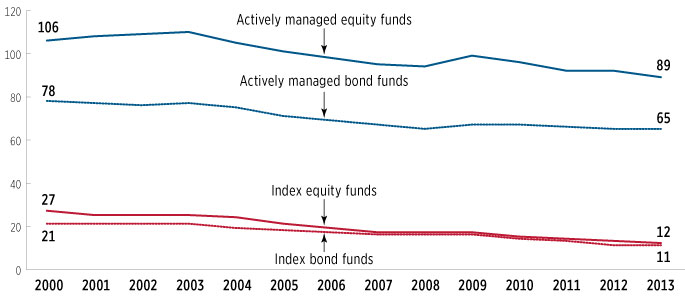

The median expense ratios for all U.S. equity and bond funds have been declining steadily since the inception of (and growing popularity of) index funds. According to analysis provided by ICI, median expense ratios have continually trended lower since 2000 (see Chart 1). The median expense ratios for index bond funds and index equity funds are 0.11% and 0.12% respectively. Interestingly, bond index funds have expense ratios that are still 50 basis points below the expense ratio for actively managed bond funds. Stock index funds have expense ratios 75 basis points below those for actively managed equity funds.

Chart 1: Median Expense Ratios by Fund Type (in basis points per year)

Sources :Investment Company Institute and Lipper

Given the consensus among experts about actively managed funds’ inability to consistently outperform their index fund counterparts, it is remarkable that the large premium in management fees has remained robust and has not eroded meaningfully since 2000. Aside: why do some investors pay for things that don’t add any value?

The impact of holding an actively managed fund that does not outperform for an extended period of time can have some interesting implications for an investor to say the least! Let’s use an example to illustrate.

Assume there are two investors, both in their 20s who both have $10,000 to invest. Further, let’s assume an average annual return in the stock market at 6.8%:

- Ben, who normally doesn’t like to overpay for things, buys generic brand pharmaceuticals and cereals. He has done his homework and recognizes that the main distinguishing factor after asset allocation in performance is the expense ratio. He is an index fund investor and enjoys saving himself unnecessary costs. Ben invests in an S&P 500 index fund with an expense ratio of 0.07%.

- Travis is a big shot and wants everyone to know it. He loves brand names too. He is a frivolous spender and leases a brand new status car every three years. He thinks his fund managers are “legit” and that they will outperform the market to help him retire early. Due to his spending habits, in order for him to meet his goals his managers must outperform the market. Travis knows he is paying more, but substantiates it to himself with his higher performance expectations. He is over-confident and often brags that his guys have outperformed the index in 5 of the last 6 years. Travis invests in an actively managed U.S. large cap stock fund with an expense ratio of 0.80%.

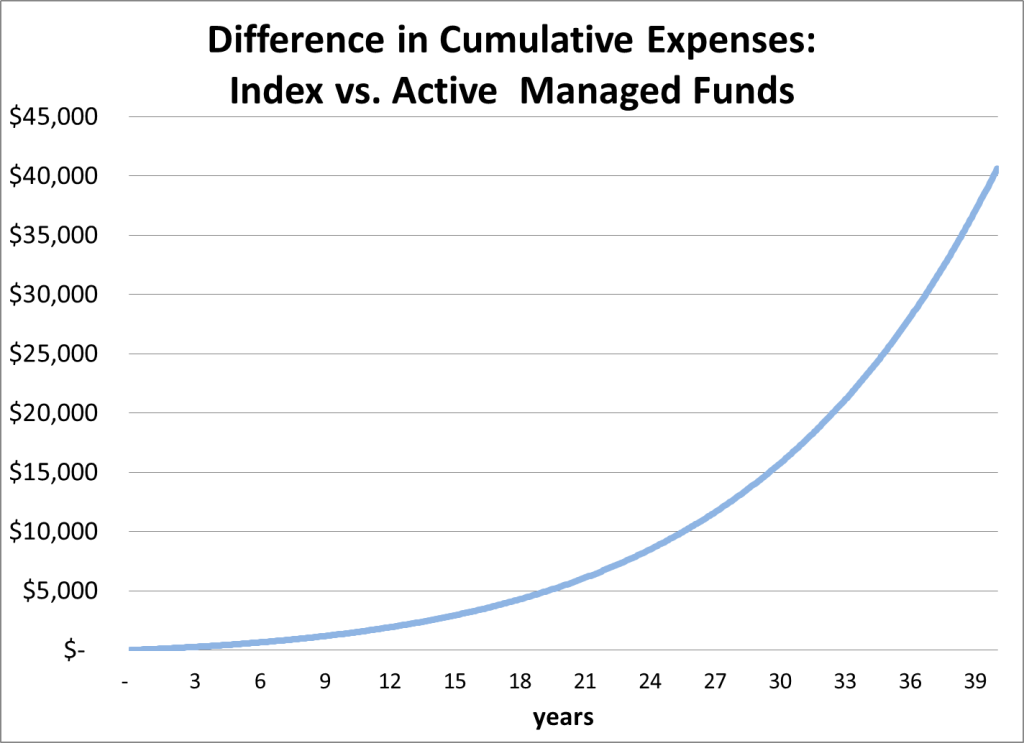

With a difference of 0.73%, the expenses are relatively similar in the first year: Ben pays $78 less than Travis. Not only will the $78 compound with interest, each year the savings will be greater than the last as the total asset value increases. Considering the compounding and the reinvestment for each additional year of increasingly widening expense discount, Ben recognizes the impact of his decision. He decides to put this money aside and track it for bragging rights. If he plans to retire in 40 years, he can rest assured that his account will be padded by over $40,000 in incremental returns compared to Travis’ account solely due to a lower expense ratio. Maybe he can help buy Travis another car?

Chart 2: Difference in Cumulative Expenses: Index vs. Active Managed Funds (assuming $10,000 initial investment, 73 basis point differential in expense ratios, and 6.8% annual market return)