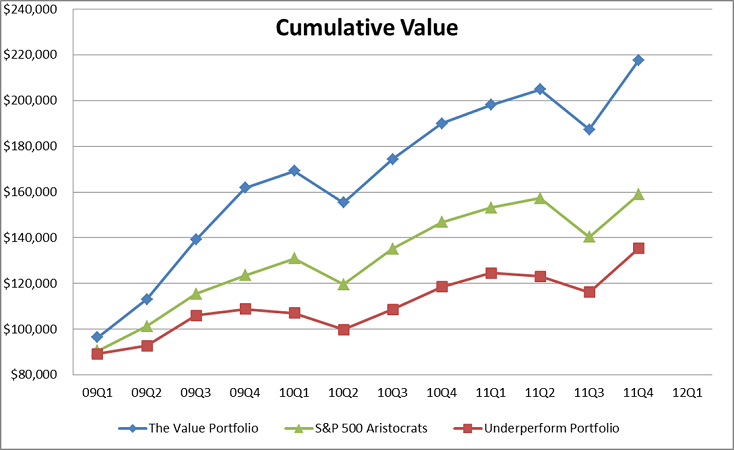

Due to the interest in my latest article on the S&P 500 Dividend Aristocrats (Finding Value in the Dividends Aristocrats List) and the discussion about backtesting, I thought I would share the empirical model I developed a few years back for forecasting total returns for The Value Portfolio (the 5 most undervalued stocks in the index). To outline the importance of value, I also created a portfolio of the 5 most expensive – The Underperform Portfolio. The results from 12 quarterly periods compared to the benchmark Dividend Aristocrats index outside of the model fitting period are shown in the chart. The full model is provided in xls linked below.