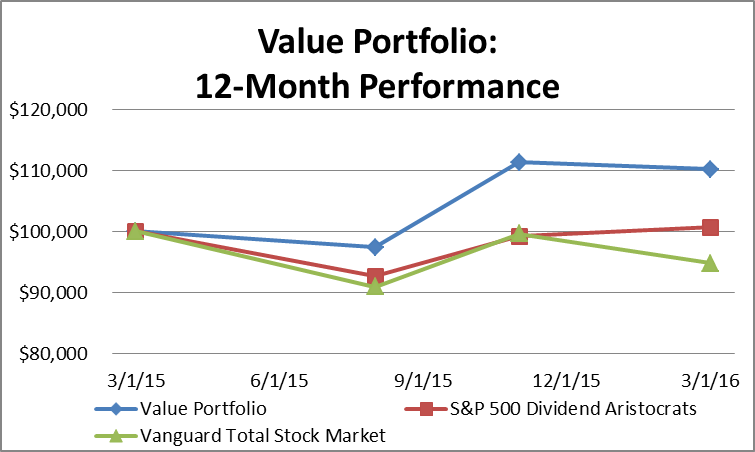

2016 began with a sharp spike in volatility with investors concerned the bull cycle could be over. Now is more than ever a great time to consider value stocks to remove risk in your stock portfolios. I have been cautious for over a year now and have a 12-month period to show results versus my two benchmarks, the Vanguard Total Stock Market ETF (VTI) and the S&P 500 Dividend Aristocrats ETF (NOBL). Since last March, the Value Portfolio has outperformed VTI by 15.4% and NOBL by 9.5%. Click here to see the March 2016 picks for value stocks in the Value Portfolio.